Foreign investment continues to withdraw from China amid its slumping economy, despite that the ruling Chinese Communist Party (CCP) has put out new incentive measures.

The CCP’s Ministry of Commerce released new data on March 22, showing that foreign direct investment flowing into China from January to February was 215.1 billion yuan ($30 billion), a fall of 19.9 percent year-on-year and the eighth consecutive month the figure has fallen. The decline was significantly larger than the number released in January, an 11.7 percent fall from the same time last year.

The Ministry of Commerce tried to downplay the sharp fall, saying on March 22 that the latest data were dwarfed by the record-high level a year earlier, adding that “foreign investment is a market behavior and data fluctuations are normal and in line with market rules.”

The CCP has recently put out new plans to attract foreign investment. However, experts pointed out that the communist regime led by Xi Jinping has prioritized political power over economic development and politicized the business environment, causing deep fear among foreign businessmen.

The General Office of the State Council of the Communist Party of China released its “Action Plan for Greater Efforts to Attract and Utilize Foreign Investment” on March 19, proposing incentive measures in five areas and emphasizing the need to strengthen the confidence of foreign investment in the development of China.

The plan includes reducing the negatives for foreign investment access, comprehensively lifting restrictions on foreign investment access in the manufacturing industry, and promoting greater opening up in the fields of telecommunications, medical care, and technological innovation. In the fields of banking, insurance, and bonds, access to foreign financial institutions will also be expanded.

Foreign Capital Outflow Continues Amid China’s Economic Downturn

Wang Guo-chen, a researcher at the Chung-Hua Institution for Economic Research in Taiwan, told The Epoch Times that the reason the CCP is adding this new action plan is that foreign investment has continued to decrease since the introduction of last year’s action plan, including in the financial industry.He also said that China’s economy is declining and needs support from foreign investment, so CCP premier Li Qiang emphasized that at the CCP’s “Two Sessions” political meetings earlier this month.

Recently, China’s urban youth unemployment rate and urban unemployment rate have been rising, and more foreign investment could help alleviate the unemployment problem.

On March 20, the CCP’s National Bureau of Statistics released China’s urban youth unemployment rate, which was 15.3 percent, excluding school students. It increased by 0.7 percent in February from the previous month.

The new action plan comes as foreign capital continues to flow out of China.

Mr. Wang said, “The launch of the new action plan shows the Beijing authorities’ anxiety about the withdrawal of foreign investment, which can also be seen from the U.S.-China meeting at the end of last year.”

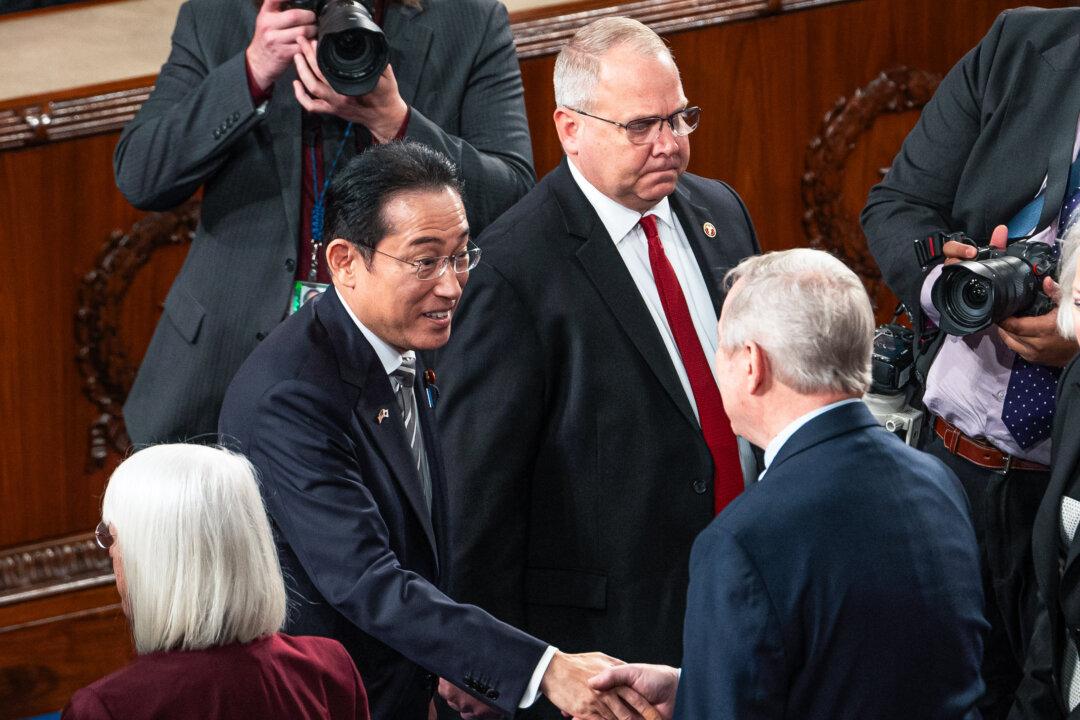

On Oct. 9, 2023, when meeting with U.S. Senate Majority Leader Chuck Schumer (D-N.Y.) in Beijing, Xi said, “The economies of China and the United States are deeply integrated, and we can benefit from each other’s development.”

However, foreign capital has continued to flee China. In January, China’s foreign investment fell 11.7 percent year-on-year to 112.71 billion yuan ($15.78 billion).

Huang Shicong, a Taiwanese economist and political commentator, told The Epoch Times that under the pressure of the confrontation between China and the United States, foreign investment in China has slowed down, and most of the investors have turned their funds to India or ASEAN countries.

“The continuous outflow of foreign capital is very harmful to China’s economy and investment, and they [the CCP] have realized this,” he said.

Safety Concerns

In 2023, the CCP raided several foreign companies’ China offices and arrested both local Chinese staff and foreign employees working in China.The U.S. ambassador to China responded to the CCP’s goal to attract more foreign investment by saying that China’s policies have been sending conflicting signals to foreign investors, especially after it enacted the sweeping anti-espionage law targeting foreign individuals and entities and Chinese people who have foreign connections. Safety is a major concern for foreign investors.

“It’s not that you just open the market then foreign businessmen will invest. If they will lose their lives and their safety is in question, who will invest?” Mr. Huang said.

In the European Chamber of Commerce in China’s 2023 Business Confidence Survey, a record 64 percent of respondents said that doing business in China was more difficult than it was in the same period in the previous year.

The European Union Chamber of Commerce in China recently published a report titled “Riskful Thinking: Navigating the Politics of Economic Security.”

CCP’s Measures Won’t Be Effective

As to whether the CCP’s new action plan to attract foreign investment would work, Mr. Huang said: “So far, Xi Jinping still seems to advocate confrontation with the United States. This general atmosphere has not changed. How to implement these plans? What if opening these markets conflicts with so-called national security issues one day? How will you deal with it? This is foreign investors’ biggest concern. So this so-called expansion of investment plan does not solve the fundamental doubts people have.”

Mr. Wang said that the main reason for the withdrawal of foreign investment is the CCP. “The first is the anti-espionage law, and the second is the regime’s emphasis on its military-industrial enterprises and state-owned enterprises, all of which endanger foreign-invested companies,” he said.

“The fundamental issue is that Xi Jinping wants to develop the economy and stabilize his regime, so he has further strengthened the Party’s control over foreign capital and foreign companies. Foreign capital must also listen to the Party’s words and command,” he added.

“If the CCP’s policies don’t change and the environment doesn’t change, no matter how many incentives you give to foreign-funded enterprises or how many markets you open up, it won’t be effective.”