Hong Kong is starting to feel the impact of the immigration wave, with a talent drain occurring across various industries. While Hong Kong authorities have been importing foreign laborers from mainland China, the effect appears contrary to the plan.

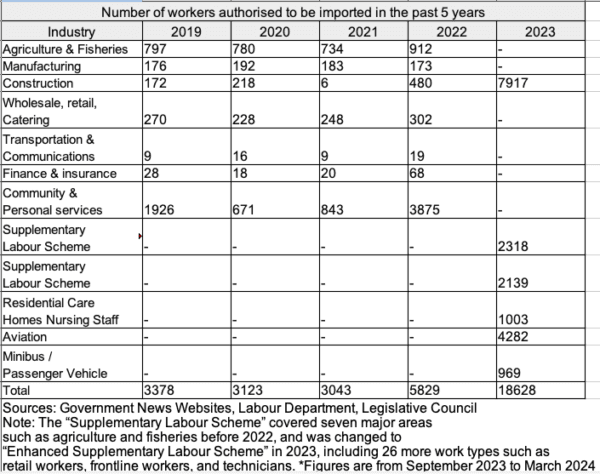

Based on data compiled by The Epoch Times, the Hong Kong authorities imported over 18,000 laborers in 2023, a 4.3-fold increase compared to 2019, when only 3,378 were imported. The workers comprise various industries and skill levels.

However, Hong Kong’s pillar industries continue to decline, with continuous layoffs in the financial sector and an overall economic contraction. As a result, while the influx of foreign labor puts pressure on local employment and wages, it may not necessarily contribute to local consumption, residency, and property purchases, forming a pure competition with the local labor force.

From 2019 to 2021, the annual number of imported foreign laborers was only slightly over 3000. However, the number began to increase in 2022, primarily due to a significant increase in imported staff for community services.

All foreign labor importation schemes were expanded after the Enhanced Supplementary Labour Scheme was implemented in 2023. Based on The Epoch Times’ statistics (Table 1), the number of imports surged from 5,829 in 2022 to 18,628 in 2023.

The number of foreign laborers in the construction industry surged to 7,917, and the Enhanced Supplementary Labour Scheme introduced in September 2023 included 26 more work types. Foreign workers were also directly imported into nursing homes, aviation, and minibus industries.

75 percent of Ironworkers Don’t Have Enough Work

Despite official claims of labor shortages, in the first quarter of 2024, Hong Kong’s unemployment rate rose by 0.1 percentage points to 3 percent, and the number of underemployed persons increased by 2,400 to 40,000.In the construction industry, which imported nearly 8,000 foreign laborers last year, the Hong Kong Construction Industry Employees General Union’s April survey showed that 75 percent of surveyed ironworkers reported no work or insufficient work, with nearly a third working only 1 to 3 days a week.

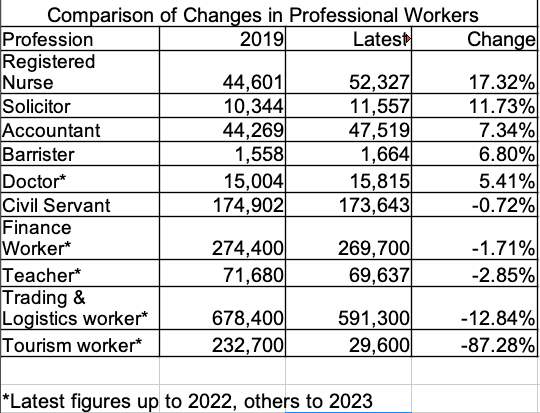

The immigration wave has also led to a change in employment structure. Figures show that in the three major industries of finance, trade, and tourism, employment decreased by 2.85 percent to 87.28 percent compared to 2019. Talent flowed more towards doctors, lawyers, and accountants, with an increase of 5.41 percent to 11.73 percent compared to 2019.

Similarly, the employment numbers of civil servants and teachers, previously considered “iron rice bowl (secure jobs),” decreased by 0.72 percent and 2.85 percent, respectively. The change in civil servants’ numbers was possibly due to the concern that becoming civil servants may affect travel and immigration, while the change in teachers’ numbers was directly related to the immigration wave-caused decline in the student population.

Moreover, amid the immigration wave, a number of parents plan to take their children overseas for education. In the future, primary and secondary schools could follow the closure trend of kindergartens, contributing to mainland students’ lack of interest in entering the teaching industry.

In the past, the main way to work in Hong Kong was to attend local universities, obtain qualifications in industries such as finance, accounting, and law, and then enter the local job market.

By the 2022/23 academic year, the number of mainland students had increased to 16,200, a sharp increase of proportion to 15.83 percent. Based on the data, mainland students who graduated from Hong Kong’s local universities can be expected to supply industries such as finance and accounting.

As of the end of February, the Hong Kong authorities’ Top Talent Pass Scheme (TTPS) had approved nearly 59,000 applications, of which 43,900 had come to Hong Kong. The authorities announced that the median monthly income for Top Talents was about HK$50,000 ($6,380), “significantly higher than the median monthly income in Hong Kong (HK$20,000 ($2,550)),” with 20 percent of them working in the financial services industry.

Hong Kong’s labor force from the lower to upper levels is undergoing changes: Lower-paying grassroots jobs are being taken by workers with lower wages, while middle-to-upper-level positions are shrinking with fierce competition.

Grassroots workers and high-quality talents coming to Hong Kong do not necessarily reside in the city, making them unable to fill the housing vacated by the immigration wave or stimulate the local retail and catering industry. As a result, mainland workers in Hong Kong only end up competing for positions and salaries with local residents.