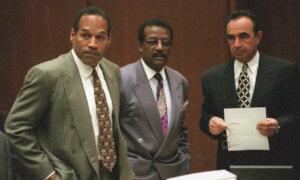

The murder charges 29 years ago was a major daily event, with front-page articles referring to multiple pieces further back in the front sections of the Los Angeles Times and Orange County Register. Both had dedicated sections, with pages of columns devoted to the prior day’s activities.

The regular daily section headings were “The O.J. Simpson Murder Trial” and “O.J. Simpson on Trial,” respectively.

The Orange County Register had one headline that described this phenom: “Glued to the tube: Viewers judge the O.J. trial,” March 11, 1995. Everyone was captivated by the drama. And almost everyone can recite defense attorney Johnnie Cochran’s line, “If it doesn’t fit, you must acquit.”

Newspapers then were more the size of what The Epoch Times print edition is today, with much more advertising content, making the first section 30 pages in length, if not longer. And the trial provided plenty of “inches” in articles and columns.

Judge Lance Ito, who presided over the murder case, would also become a household name. He would even make it to an episode of the “South Park” cartoon series and later use the rendering for his personal stationery. I know, as I received a kind note from him while I served in the California State Senate.

But O.J. Simpson was not unique in commanding a separate news section in the dailies in 1995. The Chapter 9 bankruptcy filing by the County of Orange on Dec. 6, 1994, just a few months prior, also commanded its own separate section every day in these two dailies. “Orange County in Bankruptcy” was the regular heading in the Los Angeles Times and it was “O.C. Financial Crisis” for the Orange County Register.

For the Orange County Register, the bankruptcy of the county was even a bigger story than the trial of O.J. Simpson. Its impact on this roughly 800 square-mile county was dramatic. The loss of $1.7 billion reverberated throughout its 32 cities that were voluntary depositors in the investment pool, as well as many of its special districts that thought they were financial geniuses for placing their funds there, including the second largest depositor, the Irvine Ranch Water District. All the 28 school districts were required to participate per state law.

Because the county’s bankruptcy impacted almost every governmental district, the Metro sections would have multiple articles every day on how budgets and cash flow concerns were being addressed.

Being informed of every city’s decision on suing the county, on agreeing to a settlement, or on going about it separately was a constant story. When the county stopped paying its bills, stories of nonprofits that provided services to the county and were now having their resources stretched, would be common.

Major investment banks that sold bonds and derivatives to the county were mentioned regularly, as were the rating agencies, bond counsels and municipal bankruptcy experts, as few as they were. A shaky county government created reverberations in the local real estate and job markets and even saw contributions to charities decline.

And the subjects were all over the place. Who was at fault? Who should resign? Should the county privatize? What county assets, like John Wayne Airport, should be sold? Should the voters approve a sales tax increase? How did almost everyone miss this implosion? Why were the supervisors caught off guard? Who should be fired? Who should be the new county executive officer and treasurer? What was the back story of Merrill Lynch’s involvement? Who should be recalled? Who was the grand jury interviewing? Who was the district attorney indicting?

The state was asked to intervene and then-California Assembly Speaker Willy Brown was splitting his sides mocking “conservative” Orange County during this travail. And the Assembly was in the middle of removing him as speaker, thanks to the Republicans having some 40 of the 80 seats at that time. With Sacramento being called to do something, the California State Senate established a committee to interview the players.

Every day there was a story with reporters constantly reminding readers that this was the “largest government entity in U.S. history to declare bankruptcy.”

Having elected officials asleep at the switch while the Orange County Investment Pool imploded on their watch incensed the county’s populace. Orange Countians had not seen a subject command the front page of its dailies for such a lengthy period since World War II. It was the topic which, had there still been newsboys, would have been shouted out as “Extra, Extra” on every street corner.

While the Pearl Harbor attack occurred on Dec. 7, taking our nation by surprise, the bankruptcy filing was done on the evening of Dec. 6, also stunning the residents of Orange County and the nation. Enough was revealed by numerous news accounts covering the race six months prior, that the implosion of Orange County’s Investment Pool should not have been a surprise.

The reaction to the national media attention garnered during the 1994 campaign was considered vitriol and political rhetoric and summarily dismissed by not only Orange County leadership, but the 187 participants who had invested in Citron’s Investment Pool and the local media.